WFA Post Election Musings

November has not been a great month so far for the President.

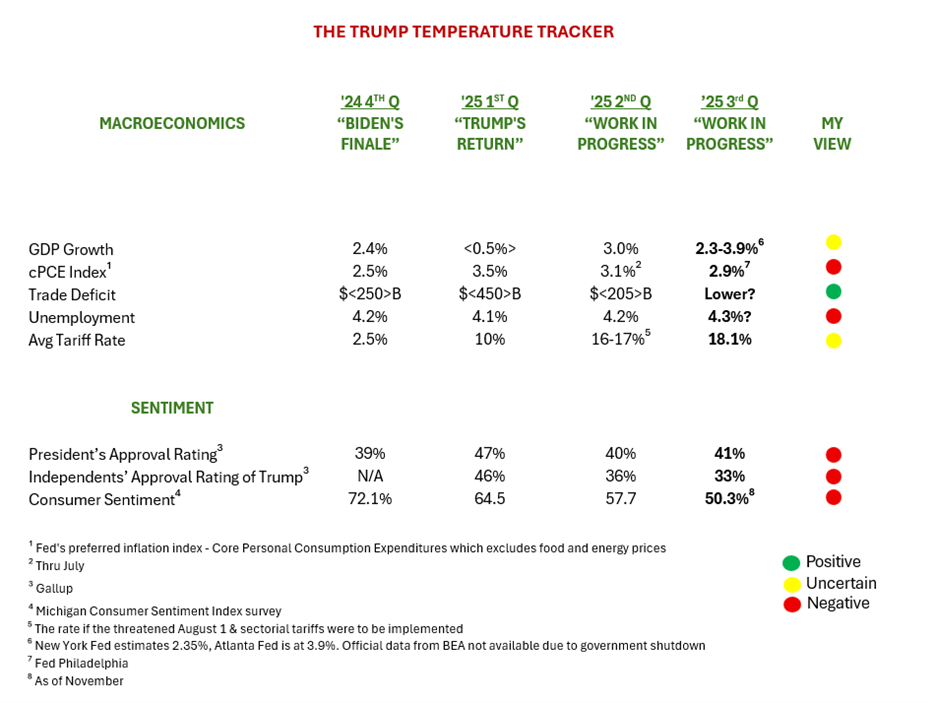

While his Gallup Presidential approval rating has held steady at a lowly 41%, consumer sentiment has fallen to a new low, inflation remains sticky around 3%, unemployment is inching up and dramatically up for new job entrants, and the off-cycle elections in Virginia, New Jersey and California sent a missile across the Republican bow. Notwithstanding initial protestations to the contrary by the President and Secretary of the Treasury, the facts spell Stagflation coupled with a very high level of discontent by the citizenry across the country. We will see what the Bureau of Economic Analysis comes up with on GDP growth and inflation once the government gets back to work, but we have not seen any positive impact other than a hefty raking in of tariff revenue of around $175 billion which will translate into a $1200 tax on each household according to the Tax Foundation rising to $1600 in 2026. It is not surprising, therefore that the President is hinting at a $2000 tariff rebate to be given to many households. In addition, the Supreme Court justices seemed to understand that tariffs are a tax which does not bode well in terms of their eventual ruling.

As we have seen in the past, this President is the master of pivoting 180 degrees from one position to another. The latest move to go on a tour of the country “To Make America Affordable Again” is Exhibit A when it comes to an about face. Whether the public accepts his new stance and credits him for a significant drop in everyday prices, should that even happen, remains to be seen. Taming inflation is one thing, actually seeing prices go down (other than some commodities) is rare-and be careful wishing for deflation! Blaming the Democrats for the sluggish economy will likely not be a winning argument. By this time in his tenure as President, he owns it. With the midterms coming up around the corner, time is not his friend.

Bottom line: The Trump Temperature Tracker looks bleak for the President. As business leaders, I would be extremely cautious about making significant capital or people investments. The stock market is not the indicator I would be using as my overall yardstick for the health of the economy. In fact, I believe we are due for a significant market correction in light of the issues I referenced above, along with what appears to be a longer road to achieving the benefits coming from the AI revolution.

My sincere best wishes for a joyful holiday season.

Onwards,

Bill